nh food tax rate

New Hampshire Corporate Income Tax Brackets New Hampshire has a flat corporate income tax rate of 8500 of gross income. Town of Amherst 2 Main.

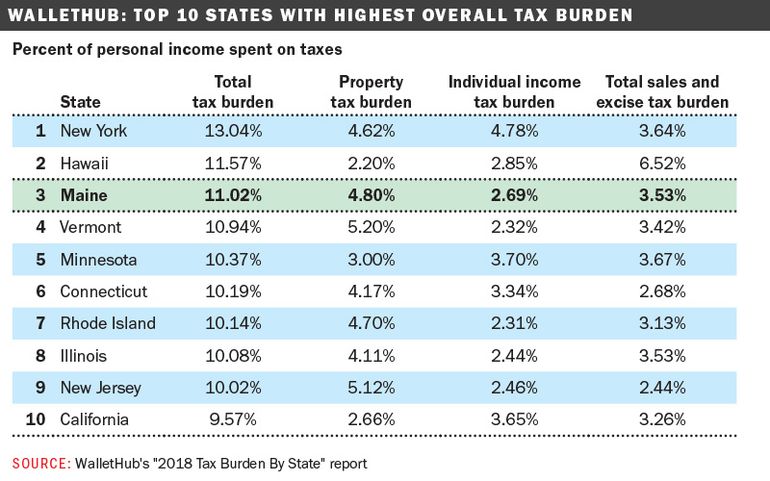

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

. PO Box 23 Ctr. The federal corporate income tax by contrast has a marginal. Food Service guidance issued on May 18 2020.

Gail Stout 603 673-6041 ext. New hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. New Hampshires sales tax rates for commonly exempted categories are listed below.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party. 45 rows Annual Tax Rate Determination Letters mailed by September 2 2022 for the tax period 712022 Q32022 through 6302023 Q22023. All documents have been saved in Portable Document Format unless otherwise.

A 9 tax is also assessed on motor vehicle rentals. Starting october 1 the tax rate for the meals and rooms rentals tax will decrease from 9 to 85. Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forward.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7. Prepared Food is subject to special sales tax rates under New Hampshire law. A 9 tax is also assessed on motor vehicle rentals.

12 Mountain View Drive Strafford NH 03884. Counties in New Hampshire collect an average of 186 of a propertys. New Hampshire Sales Tax Rate 2021.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. New Hampshire Guidance On Food Taxability Released.

A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Please note that effective October 1 2021 the Meals Rentals Tax rate is. Employers can view their current and prior.

State of New Hampshire and the Towns of Hampton North Hampton Rye. Official NH DHHS COVID-19 Update 34b. Starting october 1 the tax rate for the meals and rooms rentals tax will decrease from 9 to 85.

Some rates might be different in Portsmouth. The state meals and rooms tax is. New Hampshire Guidance On Food Taxability Released.

Year Rate Assessed Ratio. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For.

Exact tax amount may vary for different items.

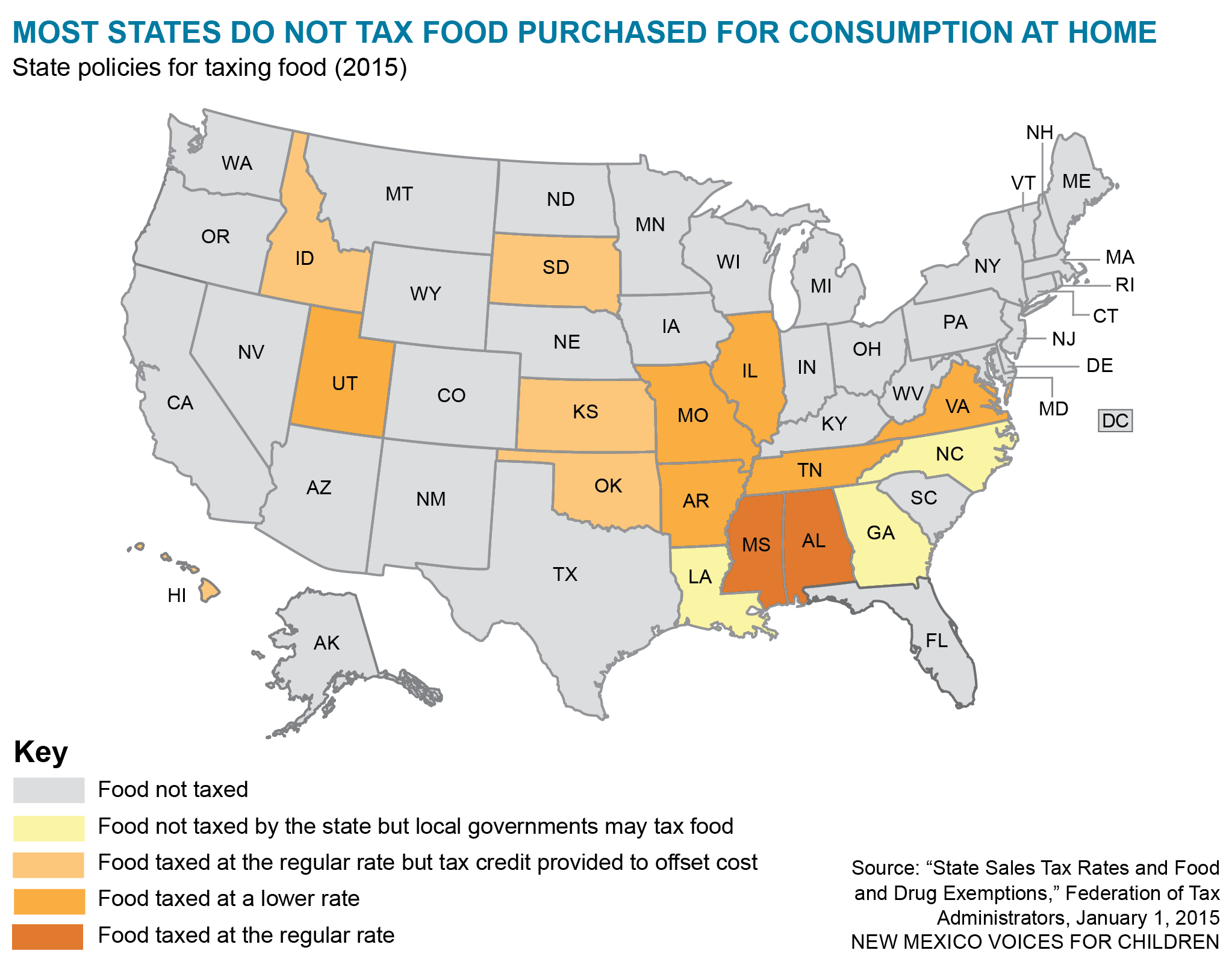

A Health Impact Assessment Of A Food Tax In New Mexico New Mexico Voices For Children

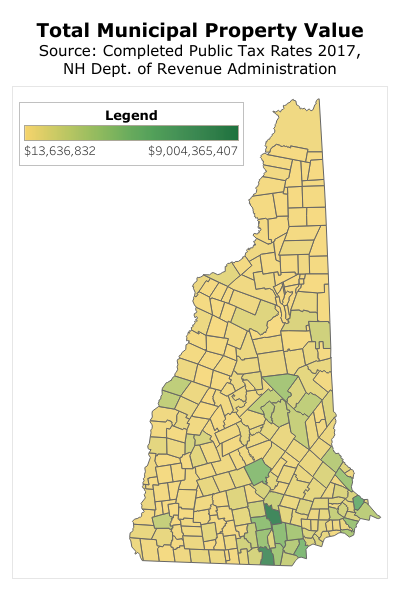

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

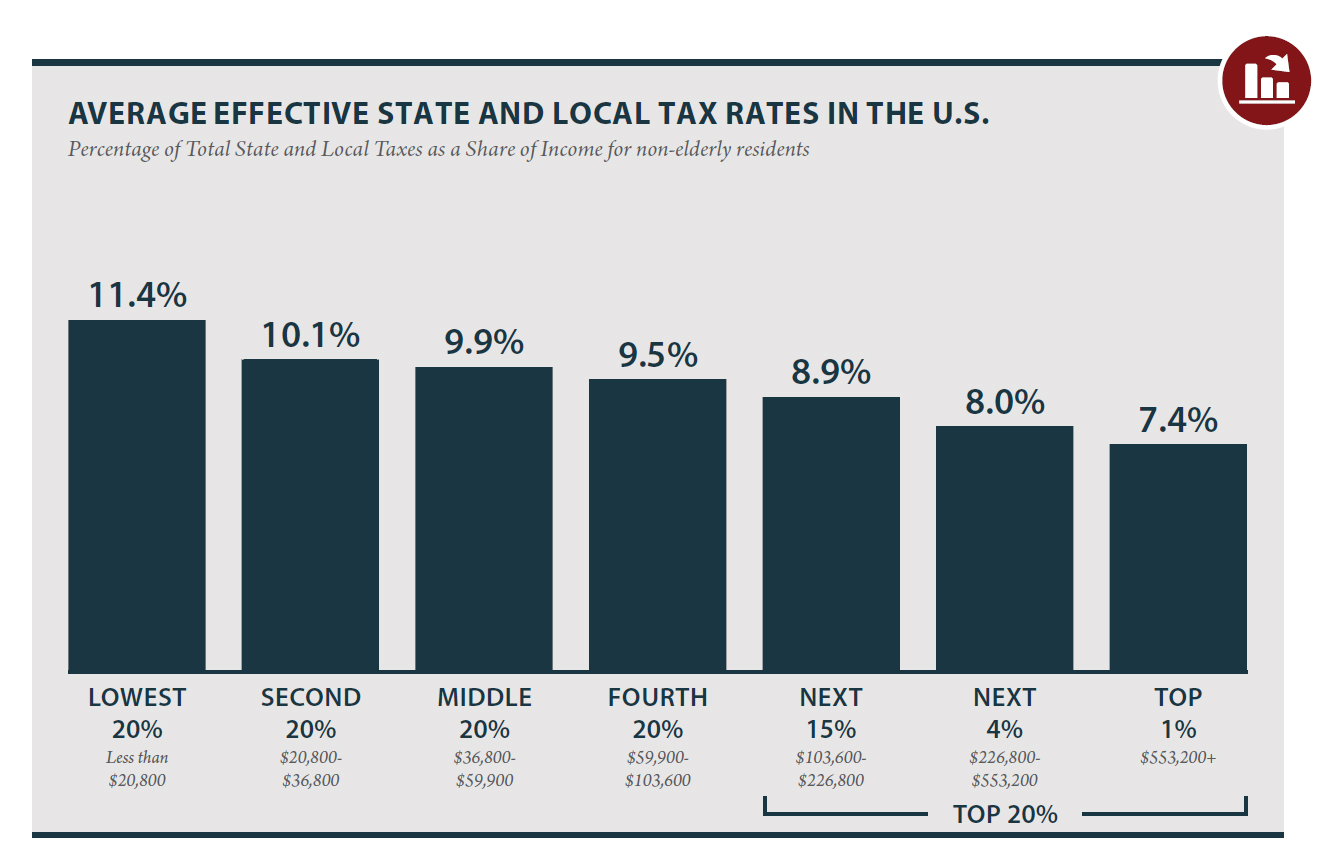

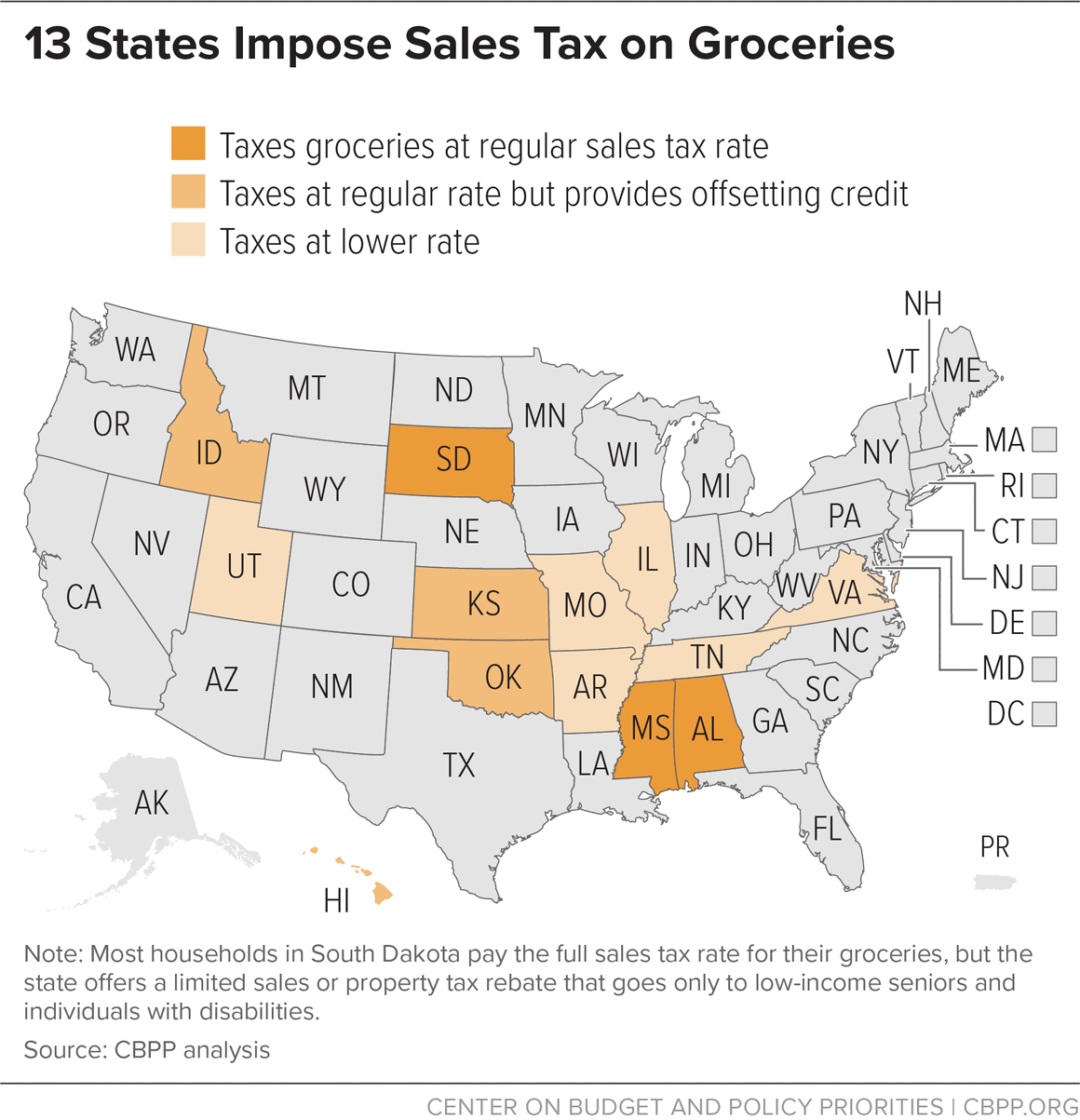

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

You Asked We Answered Why Is New Hampshire So Against Having An Income Tax New Hampshire Public Radio

New Hampshire Sales Tax Rate 2022

New Hampshire Income Tax Calculator Smartasset

Pdf Do Grocery Food Sales Taxes Cause Food Insecurity Semantic Scholar

Tax Collector Town Of Nottingham Nh

Historical New Hampshire Tax Policy Information Ballotpedia

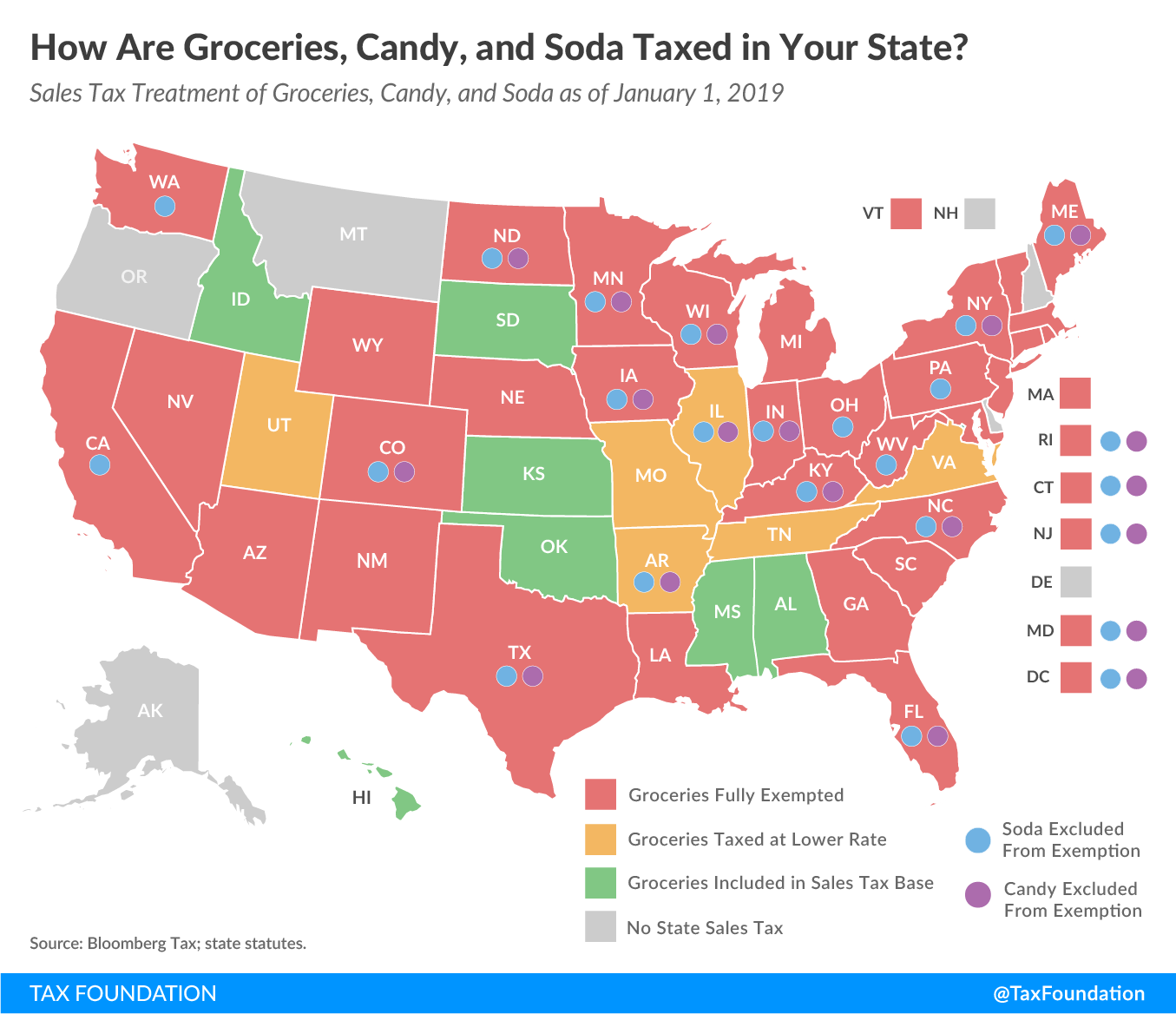

How Are Groceries Candy And Soda Taxed In Your State

States Without Sales Tax Article

The Secret To Getting A 45 Corporate Tax Rate

New Hampshire Cuts Tax On Rooms Meals To 8 5

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire